Three things you may not know about listed real estate

Listed real estate has the potential to deliver risk-adjusted returns on par with those available through physical property for investors willing to hold their investment for the longer term, which we define as five years or more.

Returns, alone, provide a compelling case for listed real estate with interest rates at historical lows. Liquidity and low transaction costs relative to direct property investment may also appeal. However, this asset class has a number of lesser known characteristics that make it a suitable investment for those seeking sustainable income potential.

Here, we look at three.

1. Attractive risk-adjusted returns

Above all, investors want results so it may be useful to compare listed real estate returns with those on offer through residential or other forms of direct property investment.

Although investors may align listed real estate with equities and view it as a short-term investment, this asset class hits its stride when held over time. Real estate, both listed and direct, is a long-term investment by the very nature of the leasing contracts and the longevity of the physical assets.

For investors willing to hold listed real estate five years or more, this asset class has the potential to bring similar returns and the same diversification benefits to a portfolio over time as physically owning the actual buildings.

Interestingly, the correlation of returns between listed and direct increases significantly as the investment horizon lengthens, given the two real estate indices relate to one another and not with the share market.

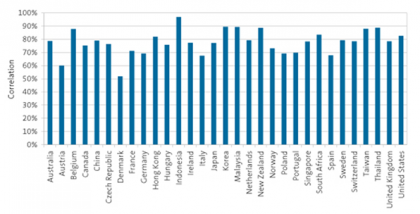

In fact, if you remove leveraging differences from both asset classes and control them for the industry practice of appraisal smoothing, the correlation between the two is in the region of 0.8 for many countries (figure 1), including Australia1.

Figure 1 – Public-private correlation

Source: Shepard, P., Y. Liu, and Y. Dai, 2014, The Barra private real estate model (PRE2), Research notes, MSCI.

2. Direct property beacon

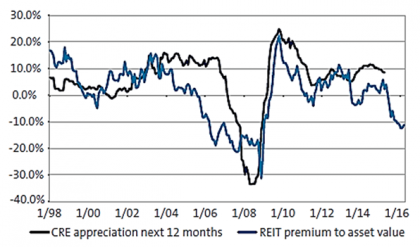

Listed real estate trusts (REITS) can also be used by investors to determine what the direct market is likely to do. Analysis of whether REITs are trading at a premium or discount to net asset value (NAV) – the value of the trust’s holdings at a given time -- has proven to be an accurate indicator of how the direct market will move in the coming year.

Put very simply, if a REIT trades at a premium to its NAV, the market believes its assets will appreciate above levels indicated by market pricing of the underlying direct real estate.

If we look at listed real estate in the US since 1998, whenever prices have been at a premium to NAV, direct real estate appreciated 96 per cent of the time in the following 12 months (figure 2).

Figure 2 – US REIT premiums to asset value and subsequent change in property values

Source: Green Street Advisors – Feb 2016

3. Global appeal

Globally, listed real estate is trading at a discount to NAV. The biggest discounts are in Asia and the UK markets. Australian REITs are trading at a premium, with larger premiums ascribed to Continental Europe and the Japanese REIT market.

In individual markets where listed real estate is trading at a discount to NAV, the best management teams are taking advantage of strong pricing in direct real estate markets, selling core assets and using the proceeds to either pay down debt or return capital to investors.

Listed real estate can be a useful proxy for direct property, especially for investors who want to establish an allocation to real estate but are struggling amid global competition for quality assets and without the headache or complexity of managing the assets.

We recognise that listed real estate was the poster child of leverage, particularly in Australia during the financial crisis. Many lessons have been learned and now listed real estate has retrieved the role for which it was intended: a proxy for direct real estate.

Recognising this significant shift, more global investors are allocating money to listed real estate.

Same but better

Listed real estate’s risk-adjusted returns are very similar to direct real estate over a time horizon of five years or more. In fact in many core markets such as the US, the returns are significantly better2. However, should the need arise, listed real estate offers a significantly higher degree of liquidity than direct.

Over the longer term, listed real estate behaves as it was always meant to – as a proxy for direct real estate investment.

Investors seeking to invest in this asset class miss out on the full potential of listed real estate if they view it as a short-term vehicle. When investing in this space, we’d advise investors to look at a long-term time horizon because that timeframe has the potential to deliver the real estate-like returns, only better. Why are the potential returns better? The net returns are typically stronger because the costs associated with listed real estate are significantly lower than investment in direct property investment.

1 Shepard, P., Y. Liu, and Y. Dai, 2014, The Barra private real estate model (PRE2), Research notes, MSCI.

2 CEM Benchmarking Shines a Light on Performance of 200 Major Pension Funds, JUNE 2016

Source: AMP Capital

James Maydew

Co-Head of Global Listed Real Estate, AMP Capital

James Maydew joined AMP Capital in 2006 and has more than 14 years’ experience in the real estate industry. Based in Sydney, he is jointly responsible for leading AMP Capital’s global listed real estate capability and investment strategy.

Important note: While every care has been taken in the preparation of this article, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided.